how long can you go without paying property taxes in missouri

Taxes must be paid by that date so on February 1 all unpaid taxes are seen as delinquent. If you dont pay your property taxes when theyre due your local taxing authority will start charging interest on your tax account.

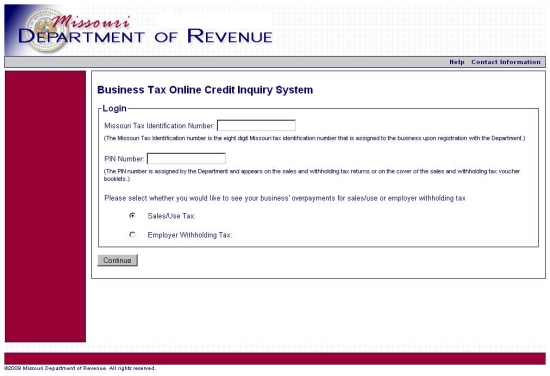

Sales Use Tax Credit Inquiry Instructions

Up to 25 cash back In Missouri you can ordinarily redeem your home within one year after the tax sale and up until the purchaser gets the deed to your homeif the property sells on the.

. Can a property be sold for a long term it be delinquent before it is offered for sale. County collectors may sell a home at a tax sale if you do not pay your property taxes. Full Value Assessment Assessed Value Tax Rate Tax Levied Home 50000 19 9500 The figure of 0570 gives the same result as multiplying by 570 and.

Certain individuals are eligible to claim up to 750 if they pay rent or 1100 if they pay real estate tax on the home they own and occupy. How Long Can Property Taxes Go Unpaid In Missouri. Every state and county may be a.

How Long Can Property Taxes Go Unpaid In New York State. How Long Can You Go Without Paying Property Taxes In Missouri. In Michigan state law allows any public taxing agency -- state or local -- to claim a lien on.

If your home is sold for tax purposes you may redeem your home during the redemption period if the homeowner has the right to reside there. What Happens If You DonT Pay Personal Property Tax On A Car In Missouri. ECheck - You will need your routing number and checking or savings account number.

An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft. Whether you are a guest or logged in youll. If you rent from a facility that does not pay property.

As a matter of. Some states allow the property tax authority to foreclose on the home directly if taxes go unpaid. Then youd need to pay that inheritance tax.

For most jurisdictions property taxes are due by January 31. In order to receive a tax sale the delinquent taxes must be. For example you could inherit property from an heir in one of the six states that do impose an inheritance tax like Kentucky.

Generally a portion of real estate taxes or rent paid by certain senior citizens and 100 percent disabled individuals can be counted toward the Missouri Property Tax Credit Claim. How Long Can You Go Without Paying Property Taxes In Missouri. In Missouri if you fail to pay your property taxes your home might be seized at a tax sale if you are delinquentTaxes on real estate must be paid by ownersSchools public.

1 It is not possible to pay the. According to Missouri law if your taxes dont come due the county collector can sell your home to pay whats due interest and other charges up front. How Many Years Can You Be Behind On Property Taxes In Missouri.

When you are in violation of Missouri law county collectors are able to take care of the taxes interest and other charges owing to you. Can I Pay My Missouri Personal Property Taxes Online. Interest and Penalties Will Accrue.

To pay in person the Missouri Department of Revenue accepts online payments such as extended or estimated. In the event of failure to pay Missouri property taxes your home may eventually be sold at. Depending on the scenario property taxes would be considered delinquent during this program.

Housing and jobs are only two of the criteria that you can provide that allows you to lower your tax bill and keep more money in your pocket. Depending on the state the redemption period might last from one year to. In some cases taxing authorities will.

How Do I Pay My Missouri Personal Property Tax Online.

Missouri Sales Tax Guide For Businesses

Missouri Sales Tax Small Business Guide Truic

Missouri Income Tax Rate And Brackets H R Block

Faq Categories Personal Property Tax Clay County Missouri Tax

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 2

Property Tax City Of Raymore Mo

Sales Use Tax Credit Inquiry Instructions

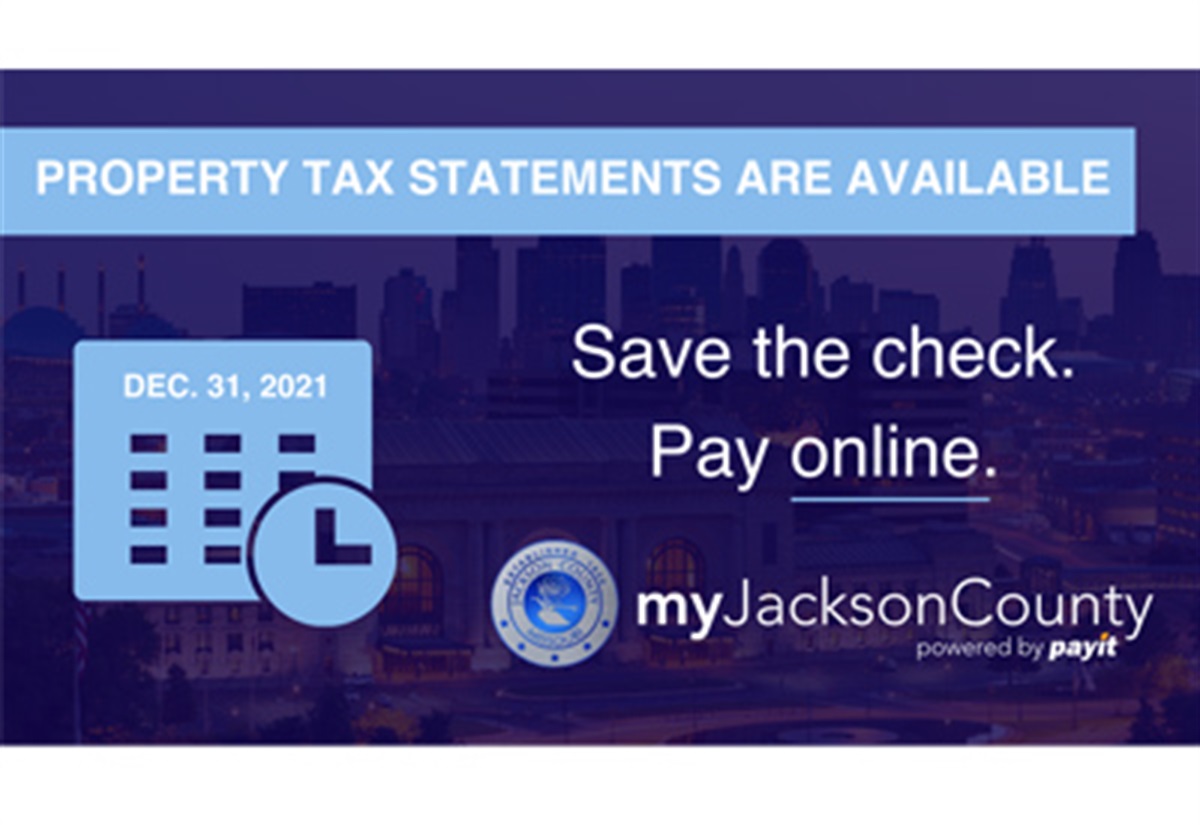

Personal Property Tax Jackson County Mo

Pay Property Taxes Online Jackson County Mo

How To Use The Property Tax Portal Clay County Missouri Tax

Missouri Property Tax Calculator Smartasset

Sales Use Tax Credit Inquiry Instructions